Ensure compliance with NAFA’s D406 declaration requirements – Arggo’s SAF-T solution enables businesses using Microsoft Dynamics 365 Business Central, NAV, or Finance & Supply Chain Management to comply with Romania’s Standard Audit File for Tax (SAF-T) reporting obligations. Automate the generation of the D406 declaration in the required XML format, ensuring accurate and timely submissions to ANAF.

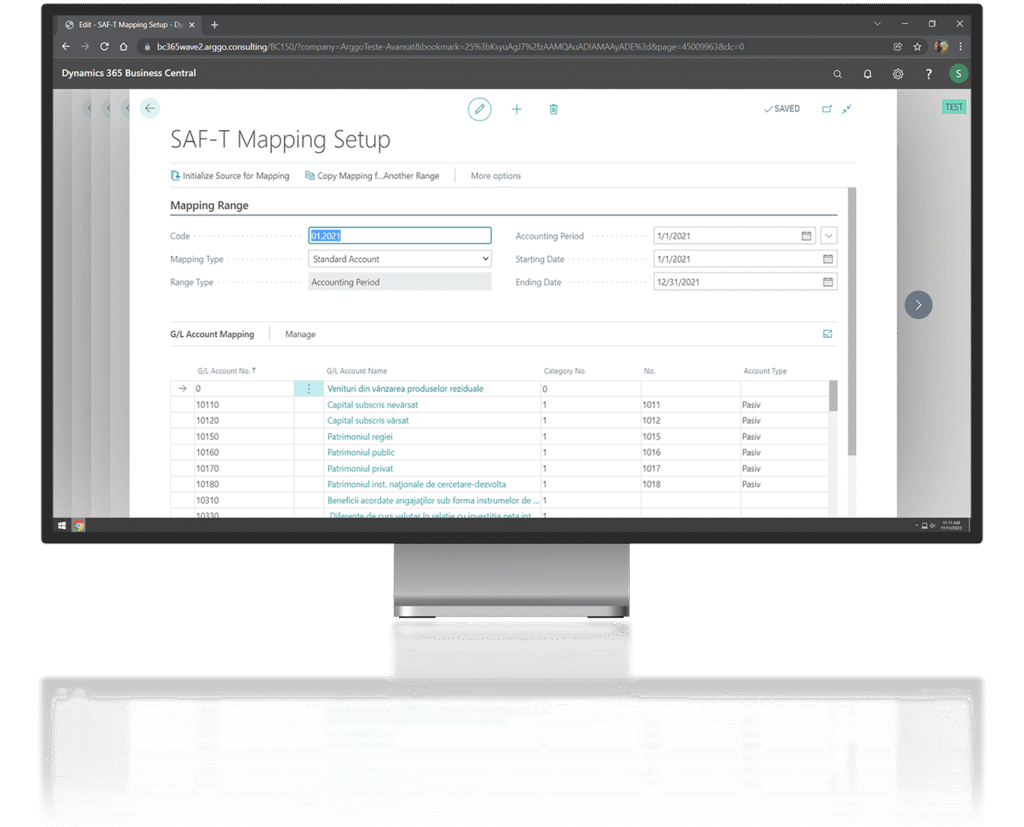

Extracts relevant financial data from the ERP system and maps it to the appropriate SAF-T structures, including general ledger, assets, inventory, accounts receivable and payable.

Automatically generates the D406 declaration in XML format, structured according to ANAF’s schema and ready for upload.

Applies over 300 validation rules to ensure data accuracy and completeness, highlighting any inconsistencies before file submission.

Since January 2022, Romanian companies classified as large taxpayers have been required to submit monthly or quarterly D406 declarations. Medium-sized taxpayers followed suit in January 2023. Starting January 1, 2025, small taxpayers will also be obligated to comply with SAF-T reporting requirements.

The process is not only time-consuming but also highly technical, requiring strict formatting and structure. Preparing this declaration manually increases the risk of submission errors, rejections, or delays that may result in penalties or unwanted scrutiny. SAF-T involves reporting financial transactions, inventory movements, fixed assets, and balances in a structured XML file that must follow both fiscal and IT specifications.

Without an automated and tested solution, the compliance burden is considerable, especially as SAF-T becomes mandatory for more taxpayer categories.

Adopting our dedicated SAF-T reporting tool removes uncertainty and manual effort. The solution helps reduce costs associated with compliance and mitigates the risks of filing errors, while offering full control and transparency over the entire process.

Ensures that all required SAF-T data is correctly formatted and encoded according to NAFA standards.

Reduces manual effort through automation of data preparation, validations, and file generation.

Helps identify missing, inconsistent, or non-compliant data early in the process.

No. These are distinct products adapted to each platform. SAF-T for Business Central/NAV and SAF-T for Finance & SCM are developed separately due to the structural differences in the systems.

Yes. The module includes both business logic validations and ANAF’s technical validation rules to ensure the file is accepted during submission.

Yes. The solution allows for configurable mappings to support different chart of accounts structures or master data models.

For companies not using Microsoft Dynamics, Arggo offers Timeqode SAF-T, a standalone solution specifically designed to integrate with any ERP system. It enables data mapping, validation, and XML generation in full compliance with ANAF’s SAF-T requirements, regardless of the underlying ERP architecture.

Explore our full portfolio of comprehensive solutions and services, from custom software development to business consulting and automation. Whatever your business needs, we deliver tailored solutions that streamline processes and enhance efficiency.

We use cookies to improve your experience. With your consent, we can process data like browsing behavior or unique IDs. Without consent, some features may not work properly.